In today’s world of cosmetic dentistry, getting a perfect smile has never been easier. Composite bonding is one of the most popular treatments, transforming your smile in one visit. However, many patients worry about the cost of this cosmetic treatment. That’s where composite bonding financing comes in: flexible dental finance plans to have dental care without compromise.

What is Composite Bonding?

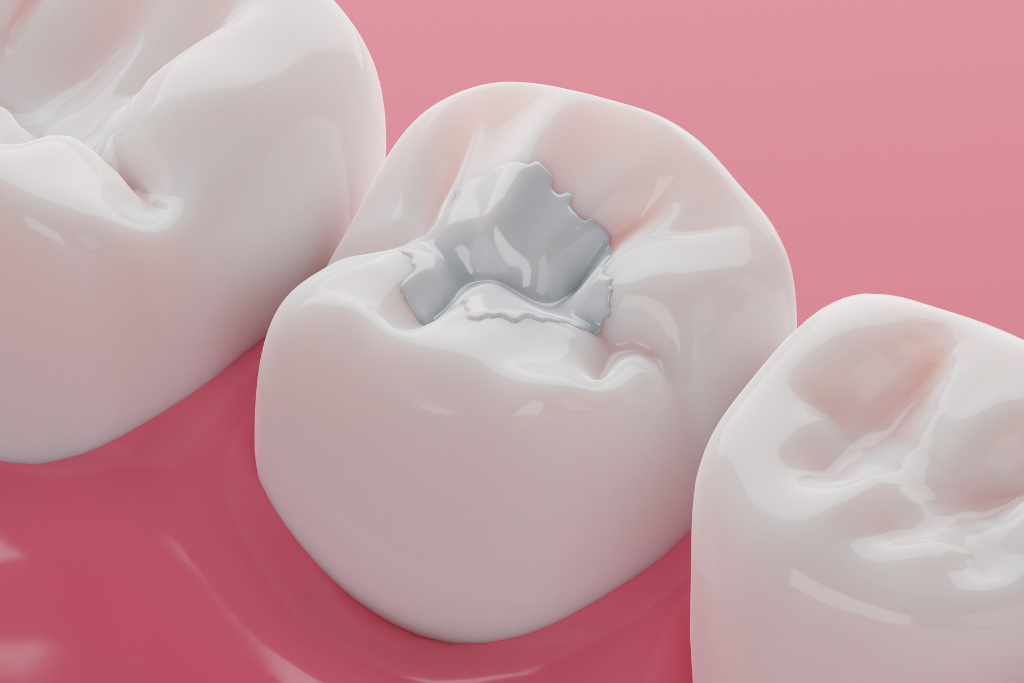

Composite bonding is a cosmetic treatment in which a tooth-coloured composite resin material is applied to the surface of your natural tooth. This bonding technique fixes chipped or cracked teeth, gaps between teeth, and discoloured teeth. The treatment involves applying thin layers of composite resin to the whole tooth; the dentist can then shape and contour the tooth to get the desired look. Unlike composite veneers, which cover the entire front of the tooth, This bonding is more conservative, preserving more of the natural tooth structure.

One of the best things about composite bonding is that it can be done in one visit. After one visit, you can leave the dentist’s office with a fresh and confident smile. It can also be combined with teeth whitening for a complete makeover and a brighter, more uniform look.

Why Consider Composite Teeth Bonding?

Composite bonding is perfect for those who want to improve their teeth without invasive procedures. It’s ideal for fixing discoloured teeth and minor chips or gaps between teeth. If you wish to enhance one or multiple teeth, composite bonding is a quick and easy way to get your ideal teeth look.

Unlike other cosmetic treatments, composite bonding requires minimal tooth preparation. The dentist applies and sculpts the composite resin, giving the tooth a natural finish. Since it can be done in one visit, it’s an excellent option for those with busy schedules or those who want immediate results.

Composite Bonding Cost and Affordability

The cost of composite bonding varies depending on the treatment required, the number of teeth involved, and the case’s complexity. While composite bonding is more affordable than other cosmetic treatments, the cost can still concern some patients. However, composite bonding financing options are available to help with the costs.

Payment plans allow you to spread the cost of your composite bonding treatment over several months, making it easier to fit into your budget. These options usually involve monthly payments tailored to your financial situation. Whether you need to finance one entire tooth or a full smile makeover, finance options are available to make the treatment more affordable.

Composite Bonding Financing: How Does it Work?

Composite bonding financing allows patients to pay for their treatment over time, not upfront, with clear terms and conditions, giving patients fair and transparent terms. Not all dental practices offer finance; they are not lenders themselves. They work with third-party finance companies that lend to patients (so they are not a lender themselves).

When choosing a finance option, you must understand the terms and conditions, interest rates, repayment period, and additional fees. Some payment plans may offer 0% interest if the balance is paid within a specific timeframe, so they’re an excellent option for those who want to spread the cost without extra charges.

Why Choose a Finance Option?

Financing composite bonding treatment has many advantages. First, it makes high-quality cosmetic treatment more affordable by breaking costs into manageable payments. So patients can get the treatment they need without delay and get their ideal smile sooner rather than later.

Also, finance options give you flexibility. You can choose a payment plan that suits your financial situation. Options are usually available for paying over six, nine, or 12 months.

The Treatment Process – How does it work?

The composite bonding process starts with a consultation, during which the dentist assesses your teeth and discusses your ideal look. Then, a detailed plan outlines the steps to achieve the best results. The dentist prepares the tooth by roughening the surface slightly so the composite resin can bond properly. The resin material is then applied in thin layers, sculpted, and hardened with a special light.

This can be done in a singular visit, so it’s a great option if you want instant results. Once the treatment is complete, your new teeth will be ready to show off.

Who is Eligible for Composite Bonding Financing?

Eligibility for composite bonding financing is usually based on a few factors, such as your credit history and current financial situation. Since finance is subject to credit checks, you must understand your credit status before applying.

Most finance providers require applicants to be over 18 and have a stable income. As with any credit agreement, the terms and conditions are status-dependent, and you need to review these before proceeding.

How do you Apply for Dental Bonding Financing?

Applying for composite bonding financing is easy. During your consultation, your dentist will explain the plan and options. If you decide to proceed with finance, you must complete an application with the finance provider. This usually requires you to provide details of your income, employment, and credit history.

Once approved, you can start your procedure knowing you have a plan to cover the expense.

Or apply for Dental Finance directly through Medicred

To apply for Dental Finance through Medicred directly, go to our website and explore the different finance options for dental treatments. Read the terms and repayment details to ensure you choose the right plan. Once you’ve decided, gather your documents (ID and proof of income) and fill in the online application form with the correct information.

After you submit your application, we will review it and let you know if you’re approved. If approved, please review the finance agreement carefully before proceeding with your dental treatment. If you have any questions during the process, email us.

Closing Thoughts – Don’t Let Money Get in the Way of Your Perfect Smile

Composite bonding will improve your look and fix many dental problems, from discoloured teeth to gaps. While the price of the dental therapy can be a concern, composite bonding finance is a solution, making high-quality cosmetic dentistry more affordable.

Composite Bonding FAQs

How much does composite bonding cost?

The price depends on the number of teeth being treated and the case’s complexity. Ask your dentist for a quote.

Can you get composite bonding on NHS?

No, composite bonding is generally not available on the NHS. The NHS typically provides dental treatments deemed medically necessary for maintaining oral health, such as fillings, extractions, and dentures.

How does the finance plan work?

Finance allows you to spread the expense over several months with monthly payments. Terms vary depending on the provider and the plan.

Is teeth whitening included in the treatment plan?

Teeth whitening can be added to the composite as part of a full smile makeover. Ask your dentist if this can be included in your plan.

You can get the smile you’ve always wanted, knowing composite bonding financing makes it all possible.